Building Resilience: 5 Ways to a Better Life

Leave a reply

October 9, 2017

Sovereign Valley Farm, Chile

On April 30, 1934, under pressure from Italian-American lobby groups, the United States Congress passed a law enshrining Columbus Day as a national holiday.

President Franklin Roosevelt quickly signed the bill into law, and the very first Columbus Day was celebrated in October of that year.

Undoubtedly people had a different view of the world back then… and a different set of values.

Few cared about the plight of the indigenous who were wiped out as a result of European conquest.

Even just a few decades ago when I was a kid in elementary school, I remember learning that ‘Columbus discovered America’. There was no discussion of genocide.

It wasn’t until I was a sophomore at West Point that I picked up Howard Zinn’s People’s History of the United States (and then Columbus’s own diaries) and started reading about the mass-extermination of entire tribes.

Columbus himself wrote about his first encounter with the extremely peaceful and welcoming Arawak Indians of the Bahama Islands:

“They do not bear arms, and do not know them, for I showed them a sword, they took it by the edge and cut themselves out of ignorance. They have no iron…They would make fine servants…With fifty men we could subjugate them all and make them do whatever we want.”

And so he did.

“I took some of the natives by force in order that they might learn and might give me information of whatever there is in these parts.”

Columbus had already written back to his investors in Spain, Ferdinand and Isabella, that the Caribbean islands possessed “great mines of gold.”

It was all lies. Columbus was desperately attempting to justify their investment.

In Haiti, Columbus ordered the natives to bring him all of their gold. But there was hardly an ounce of gold anywhere on the island. So Columbus had them slaughtered. Within two years, 250,000 were dead.

Now, this letter isn’t intended to rail against Columbus. Point is, I never learned any of this information in school. Decades ago, no one really did.

But today, people are starting to be aware of what Columbus did. And our values are vastly different today than they were in 1937. Or in 1492.

Decades ago… and certainly hundreds of years ago… the idea of a ‘superior race’ still prevailed, endowed by their creator with the right to subjugate all inferior races.

This readily-accepted belief was the pretext of slavery and genocide.

Even as recently as the early 1900s, there were entire fields of ‘science’ devoted to studying the technical differences among various races and drawing data-driven conclusions about superiority.

Phrenologists, for example, would take precise measurements of people’s skulls– the circumference of the head, the ratio of forehead to eyebrow measurements, etc.– and deduce the intellectual capacity and character traits of entire races.

Jews could not be trusted. Blacks and Asians were inferior. These assertions were based on ‘scientific evidence’, even in nations like Sweden, the United Kingdom, and United States.

Today we’re obviously more advanced than our ancestors were. We know that their science was complete bullshit, and our values are totally different.

There are entire movements now (particularly among university students) to remove statues, rename buildings, and re-designate holidays.

Frankly this is a pretty slippery slope. If we judge everyone throughout history based on our values today, we’ll never stop tearing down monuments.

Even someone as forward-thinking as Thomas Jefferson owned slaves. And that’s a LOT of elementary schools to rename.

More importantly, there will come a time in the future when our own descendants judge us harshly for our short-sighted values.

Fortunately we no longer have faux-scientists today writing dissertations about racial superiority.

But we do have entire fields of ‘science’ that will truly bewilder future historians. Economics is one of them.

Our society awards some of its most distinguished prizes for intellectual achievement to economists who tell us that the path to prosperity is to print money, raise taxes, and go into debt.

Economists tell us that we can spend our way out of recession, borrow our way out of debt, and that there will never be any consequences from conjuring trillions of units of paper currency out of thin air.

They created a central banking system whereby an unelected committee of economists possesses nearly totalitarian control of the money supply… and hence the power to influence the price of EVERYTHING– food, fuel, housing, utilities, financial markets, etc.

Economists have managed to convince the world that inflation, i.e. rising prices, is actually a GOOD thing… and that prices quadrupling and quintupling during the average person’s lifespan is ‘normal’.

They’ve also succeeded in making policy-makers terrified of deflation (falling prices) even though just about any rational individual would naturally prefer falling (or at least stable) prices to rising prices.

Economists make the most ridiculous assertions, like “The debt doesn’t matter because we owe it to ourselves…” as if it’s perfectly acceptable for the US government to default on its citizens.

Or that the US economy is so strong because the American consumer spends so much money, i.e. consumption (and not production) drives prosperity.

The public believes all this nonsense because the ‘scientists’ say it’s true.

The scientists also come up with fuzzy mathematics to support their assertions. Last Friday, for example, the Labor Department reported that the US economy lost 33,000 jobs in September.

Yet miraculously the unemployment rate actually declined, i.e. fewer people are unemployed despite there being fewer jobs in the economy.

None of this makes any sense. Fewer jobs means lower unemployment. Spend more money. Print more money. Borrow more money. Debt is wealth. Consumption is prosperity.

All of this is based on ‘science’.

We may rightfully take umbrage with the values and ideas of our ancestors.

But it’s worth turning that mirror on ourselves and examining our own beliefs… for there will undoubtedly come a time when our own descendants wonder how we could have been so foolish.

Reposted from SovereignMan

Shame On Us

Shame on us for believing it is somehow compassionate to take the hard-earned resources of one individual and giving it to another.

Shame on us that we’ve forgotten that the “Government” is us, that whatever monies it has is our friends, our neighbors and individuals we do not know.

Shame on us for permitting legislators to throw about our earnings like so much candy to buy votes, to curry favor and seduce us into supposedly good things, all the while doing little more than spend money that is not theirs without regard of the costs to us.

Shame on us for assuming that because we think it’s a good idea to do such-and-such that every should be compelled by law to support it, even if they disagree.

Shame on us for daring to believe that what is our neighbors is ours to direct and allocate under penalty of law.

Shame on us for permitting our own self interest to pervert law into the means by which we take from others to line our own pockets (subsidies, credits, socialized healthcare, etc.).

Shame on us for daring to blindly throw about the hard-earned monies of each other as though it were ours to control and not the ones who earned it.

Shame on us for eagerly endorsing law that amounts to little more than theft.

Shame on us for forgetting it is NOT government but us, WE the People, that are the solutions.

Shame on us for being suspicious of anyone suggesting something could be better accomplished without doing so through government.

Shame on us for distrusting each other so much as to bind each other in the chains of legislation blindly believing that coercion and forced re-allocation will some how redress inequities.

Shame on us for refusing to resist the temptation to use law to coerce others to doing only what we approve of; for criminalizing rudeness and offensive behavior.

Shame on us for lacking the will and determination to win hearts and minds by example and persuasion and deeming ourselves the moral conscience and judge of our neighbors when they disagree with our particular views.

Shame on us for decimating the rule of law in favor of the rule of the mob.

Shame on us for preferring chains over liberty; for what we leave the next generation.

Shame on us.

Find this blog of interest and value? Share it freely; help keep it going…..

In a column from December of 2015, the Wall Street Journal’s Mary O’Grady unveiled an inconvenient fact that poverty warriors on the American left and right would perhaps prefer remain hidden: from 1980 to 2000, when the U.S. economy boomed, the number of Mexican arrivals into the U.S. grew from 2.2 million in 1980 to 9.4 million in 2000. The previous number is a clear market signal that the U.S. is where poverty has always been cured, as opposed to a condition that requires specific U.S. policy fixes.

Economic progress always and everywhere springs from investment.

O’Grady’s statistics came to mind while reading a recent New York Times column by Jared Bernstein, a senior fellow at the Center on Budget and Policy Priorities. He writes that a “highly progressive agenda [from Democratic scholars and politicians] has been coming together in recent months, one with the potential to unite both the Hillary and Bernie wings of the party, to go beyond both Clintonomics and Obamanomics.”

The problem is that the agenda that’s got Bernstein so giddy has nothing to do with the very economic growth that is always the source of rising economic opportunity for the poor, middle and rich.

More Welfare

Up front, Bernstein expresses excitement about a $190 billion (annually) program that he describes as a “universal child allowance.” The allowance would amount to annual federal checks sent to low-income families of $3,000/child. It all sounds so compassionate on its face to those who think it kind for Congress to spend the money of others, but given a second look even the mildly sentient will understand that economic opportunity never springs from a forcible shift of money from one pocket to another. If it were, theft would be both legal and encouraged.

The very economic growth in the U.S. that has long proven a magnet for the world’s poorest springs not from wealth redistribution, but instead from precious capital being matched with entrepreneurs eager to transform ideas into reality. Just as the U.S. economy wouldn’t advance if Americans with odd-numbered addresses stealthily ‘lifted’ $3,000 each from those with even-numbered addresses, neither will it grow if the federal government is the one taking from some, only to give to others.

Economic progress always and everywhere springs from investment, yet Bernstein is arguing with a straight face that the U.S.’s poorest will be better off if the feds extract $190 billion of precious capital from the investment pool. As readers can probably imagine, he doesn’t stop there.

Government Jobs

Interesting is that Bernstein’s next naïve suggestion involves “direct job creation policies, meaning either jobs created by the government or publicly subsidized private employment.” Ok, but all jobs are a function of private wealth creation as Bernstein unwittingly acknowledges given his call for resource extraction from the private sector in order to create them.

Government can’t create any work absent private sector wealth, so why not leave precious resources in the hands of the true wealth creators?

This begs the obvious question why economic opportunity would be enhanced if the entrepreneurial and business sectors had less in the way of funds to innovate with. But that’s exactly what Bernstein is seeking through his $190 billion “universal child allowance,” not to mention his call for more “jobs created by the government.”

Stating what’s obvious even to Bernstein, government can’t create any work absent private sector wealth, so why not leave precious resources in the hands of the true wealth creators? Precisely because they’re wealth focused, funds kept in their control will be invested in ways that foster much greater opportunity than can politicians consuming wealth created by others.

Contradictions Abound

Still, Bernstein plainly can’t see just how contradictory his proposals are; proposals that explicitly acknowledge where all opportunity emerges from. Instead, he calls for more government programs. Specifically, he’s proposing a $1 trillion expansion of the “earned-income tax credit” meant to pay Americans to go to work.

As he suggests, the $1 trillion of funds extracted from the productive parts of the economy would lead to family of four tax credits of $6,000 in place of the “current benefit of about $2,000.” Ok, but what goes unexplained here is why we need to pay those residing in the U.S. to work in the first place.

What gives life to the above question is the previously mentioned influx of Mexican strivers into the U.S. during the U.S. boom of the 80s and 90s. What the latter indicated clearly is that economic growth itself is the greatest enemy poverty has ever known. It also indicated that work is available to those who seek it, and even better, the work available is quite a bit more remunerative than one could find anywhere else in the world.

The U.S. has long been very unequal economically, yet the world’s poorest have consistently risked their lives to get here.

Rest assured that the U.S. hasn’t historically experienced beautiful floods of immigration because opportunity stateside was limited. People come here because the U.S. is once again the country in which the impoverished can gradually erase their poverty thanks to abundant work opportunities. If Mexicans who frequently don’t speak English can improve their economic situations in the U.S., why on earth would the political class pay natives who do speak the language to pursue the very work that is the envy of much of the rest of the world?

Put rather simply, those who require payment above and beyond their wage to get up and go in the morning have problems that have nothing to do with a lack of work, and everything to do with a lack of initiative. Importantly, handouts from Washington logically won’t fix what is a problem of limp ambition. At best, they’ll exacerbate what Bernstein claims to want to fix.

Inequality Hurts No One

Most comical is Bernstein’s assertion that the tax credits will allegedly mitigate “the damage done to low- and moderate-wage earners by the forces of inequality that have steered growth away from them” in modern times. What could he possibly mean? The U.S. has long been very unequal economically, yet the world’s poorest have consistently risked their lives to get here precisely because wealth gaps most correlate with opportunity.

Translated, investment abundantly flows to societies where individuals are free to pursue what most elevates their talents (yes, pursuit of what makes them unequal), and with investment comes work options for everyone. Doubters need only travel to Seattle and Silicon Valley, where the world’s five most valuable companies are headquartered, to see up close why the latter is true.

Similarly glossed over by this confused economist is that rising inequality is the The same lame-brained policies of redistribution that the left have been promoting for decades.

surest sign of a shrinking lifestyle inequality between the rich and poor. We work in order to get, and thanks to rich entrepreneurs more and more Americans have instant access at incessantly falling prices to the computers, mobile phones, televisions, clothing and food that were once solely the preserve of the rich.

Just once it would be nice if Bernstein and the other class warriors he runs with would explain how individual achievement that leads to wealth harms those who aren’t rich. What he would find were he to replace emotion with rationality is that in capitalist societies, people generally get rich by virtue of producing abundance for everyone. In short, we need more inequality, not less, if the goal is to improve the living standards of those who presently earn less.

Remarkably, Bernstein describes the ideas presented as “bold” and “progressive,” but in truth, they’re the same lame-brained policies of redistribution that the left have been promoting for decades. And as they’re anti-capital formation by Bernstein’s very own admission, they’re also inimical to the very prosperity that has long made the U.S. the country where poverty is cured. To be clear, if this is the best the Democrats have, they’ll long remain in the minority.

John Tamny is a Forbes contributor, editor of RealClearMarkets, a senior fellow in economics at Reason, and a senior economic adviser to Toreador Research & Trading. He’s the author of the 2016 book Who Needs the Fed? (Encounter), along with Popular Economics (Regnery Publishing, 2015).

This article was originally published on FEE.org. Read the original article.

June 4, 2017 by Dan Mitchell

Back in 2015, I basically applauded the Congressional Budget Office for its analysis of what would happen if Obamacare was repealed. The agency’s number crunchers didn’t get it exactly right, but they actually took important steps and produced numbers showing how the law was hurting taxpayers and the economy.

Now we have a new set of Obamacare numbers from CBO based on the partial repeal bill approved by the House of Representatives. The good news is that the bureaucrats show substantial fiscal benefits. There would be a significant reduction in the burden of spending and taxation.

Now we have a new set of Obamacare numbers from CBO based on the partial repeal bill approved by the House of Representatives. The good news is that the bureaucrats show substantial fiscal benefits. There would be a significant reduction in the burden of spending and taxation.

But the CBO did not show very favorable numbers in other areas, most notably when it said that 23 million additional people would be uninsured if the legislation was enacted.

Part of the problem is that Republicans aren’t actually repealing Obamacare. Many of the regulations that drive up the cost of health insurance are left in place.

My colleague at Cato, Michael Cannon, explains why this is a big mistake.

Rather than do what their supporters sent them to Washington to do – repeal ObamaCare and replace it with free-market reforms – House Republicans are pushing a bill that will increase health-insurance premiums, make health insurance worse for the sick… ObamaCare’s core provisions are the “community rating” price controls and other regulations that (supposedly) end discrimination against patients with preexisting conditions. …Community rating is the reason former president Bill Clinton called ObamaCare “the craziest thing in the world” where Americans “wind up with their premiums doubled and their coverage cut in half.” Community rating is why women age 55 to 64 have seen the highest premium increases under ObamaCare. It is the principal reason ObamaCare has caused overall premiums to double in just four years. Community rating literally penalizes quality coverage for the sick… ObamaCare is community rating. The AHCA does not repeal community rating. Therefore, the AHCA does not repeal ObamaCare.

It would be ideal if Republicans fully repealed Obamacare.

Heck, they should also address the other programs and policies  that have messed up America’s healthcare system and caused a third-party payer crisis.

that have messed up America’s healthcare system and caused a third-party payer crisis.

That means further reforms to Medicaid, as well as Medicare and the tax code’s exclusion of fringe benefits.

But maybe that’s hoping for too much since many Republicans are squeamish about supporting even a watered-down proposal to modify Obamacare.

That being said, there are some reasonable complaints that CBO overstated the impact of the GOP bill.

Doug Badger and Grace Marie Turner, for instance, were not impressed by CBO’s methodology.

The Congressional Budget Office (CBO) launched its latest mistaken Obamacare-related estimate this week, predicting that a House-passed bill to repeal and replace the embattled law would lead to 23 million more uninsured people by 2026. …the agency’s errors are not only massive – one of their predictions of 2016 exchange-based enrollment missed by 140%… Undaunted by failure and unschooled by experience, CBO soldiers on, fearlessly predicting that millions will flock to the exchanges any day now. …CBO measures the House-passed bill against this imaginary baseline and finds it wanting. …One reason CBO gets it so wrong so consistently is its fervent belief that the individual mandate has motivated millions to enroll in coverage. …CBO’s belief in the power of the individual mandate is misplaced. …The IRS reports that in the 2015 tax year, 6.5 million uninsured filers paid the tax penalty, 12.7 million got an exemption and additional 4.2 million people simply ignored the penalty. They left line 61 on their form 1040 blank, refusing to tell the government whether or not they had insurance. …In all, that is a total of 23.4 million uninsured people – out of an estimated 28.8 million uninsured – who either paid, avoided or ignored the penalty. That hardly suggests that the mandate has worked.

The Wall Street Journal also was quite critical of the CBO analysis.

…the budget scorekeepers claim the House bill could degrade the quality of insurance. This editorializing could use some scrutiny. Without government supervision of insurance minutiae and a mandate to buy coverage or pay a penalty, CBO asserts, “a few million” people will turn to insurance that falls short of the “widely accepted definition” of “a comprehensive major medical policy.” They might select certain forms of coverage that Obama Care banned, like “mini-med” plans with low costs and low benefits.

Or they might select indemnity plans that pay a fixed-dollar amount per day for illness or hospitalization, or dental-only or vision-only single-service plans. CBO decided to classify these people as “uninsured,” though without identifying who accepts ObamaCare’s definition of standardized health benefits and why they deserve to substitute their judgment for the choices of individual consumers. …But the strangest part of CBO’s preoccupation with “high-cost medical events” is that the analysts never once mention catastrophic coverage—not once. These types of plans didn’t cover routine medical expenses but they did protect consumers against, well, a high-cost medical event like an accident or the diagnosis of a serious illness. Those plans answered what most people want most out of insurance—financial security and a guarantee that they won’t be bankrupted by cancer or a distracted bus driver. …under the House reform Americans won’t have any problem insuring against a bad health event, even if CBO won’t admit it. …CBO has become a fear factory because it prefers having government decide for everybody.

Drawing on his first-hand knowledge, Dr. Marc Siegel wrote on the issue for Fox News.

…23 million…will lose their health insurance by 2026 if the American Health Care Act, the bill the House passed to replace ObamaCare, is passed in the Senate and signed by President Trump. This number is concerning — until you look at it and the CBO’s handling of the health care bills more closely. …First, the CBO was wildly inaccurate when it came to ObamaCare, predicting that 23 million people would be getting policies via the exchanges by 2016. The actual number ended up being only 10.4 million… Second, many who chose to buy insurance on the exchanges did so only because they wanted to avoid paying the penalty, not because they needed or wanted the insurance. Many didn’t buy insurance until they got sick.

The Oklahoman panned the CBO’s calculations.

IN the real world, people who don’t have insurance coverage cannot lose it. Yet…the CBO estimates 14 million fewer people will have coverage in 2018 if the House bill is enacted than would be the case if the ACA is left intact, and 23 million fewer by 2026. …In 2016, there were roughly 10 million people obtaining insurance through an Obamacare exchange. The CBO estimated that number would suddenly surge to 18 million by 2018 if the law was left intact, but that far fewer people would be covered if the House reforms became law. Put simply, the CBO estimated that millions of people who don’t have insurance through an exchange today would “lose” coverage they would otherwise obtain next year. That’s doubtful. …At one point, the office estimated 22 million people would receive insurance through an Obamacare exchange by 2016. As already noted, the actual figure was less than half that. One major reason for the CBO being so far off the mark is that federal forecasters believed Obamacare’s individual mandate would cause people to buy insurance, regardless of cost. That hasn’t proven true. …In a nutshell, the CBO predicts reform would cause millions to lose coverage they don’t now have, and that millions more would eagerly reject the coverage they do have because it’s such a bad deal. Those aren’t conclusions that bolster the case for Obamacare.

And here are passages from another WSJ editorial.

CBO says 14 million fewer people on net would be insured in 2018 relative to the ObamaCare status quo, rising to 23 million in 2026. The political left has defined this as “losing coverage.”

But 14 million would roll off Medicaid as the program shifted to block grants, which is a mere 17% drop in enrollment after the ObamaCare expansion. The safety net would work better if it prioritized the poor and disabled with a somewhat lower number of able-bodied, working-age adults. The balance of beneficiaries “losing coverage” would not enroll in insurance, CBO says, “because the penalty for not having insurance would be eliminated.” In other words, without the threat of government to buy insurance or else pay a penalty, some people will conclude that ObamaCare coverage isn’t worth the price even with subsidies. …CBO’s projections about ObamaCare enrollment…were consistently too high and discredited by reality year after year. CBO is also generally wrong in the opposite direction about market-based reforms, such as the 2003 Medicare drug benefit whose costs the CBO badly overestimated.

Here are excerpts from Seth Chandler’s Forbes column.

My complaints about the CBO largely revolve around its dogged refusal to adjust its computations to the ever-more-apparent failings of the Affordable Care Act. When the CBO says that 23 million fewer people will have insurance coverage under the AHCA than under the ACA — a statistic that politics have converted into a mantra — that figure is predicated on an ACA that no longer exists. It is based on the continuing assumption that the ACA will have 18 million people enrolled on its exchanges in 2018 and that this situation will persist until 2026. I know no one on any side of the political spectrum who believes this to be true. The ACA has about 11 million people currently enrolled on its exchanges in 2017 and, with premiums going up, some insurers withdrawing from various markets, and the executive branch fuzzing up whether the individual mandate will actually be enforced. The consensus is that ACA enrollment will stay the same or go down, not increase 60%.

And here’s some of what Drew Gonshorowski wrote for the Daily Signal.

…reducing premium levels by rolling back regulations could actually have the effect of making plans more desirable for individuals looking to pay less. The CBO lacks any real discussion of these positive effects. …The CBO’s score on Medicaid…reflects that it assumes more states would likely have expanded in the future under the Affordable Care Act. Thus, its projection that 14 million fewer people would be insured due to not having Medicaid under the American Health Care Act might be overstated… CBO…assumes the Affordable Care Act will enroll 7 to 8 million more people in the individual market, when in reality it does not appear this will be the case

Last but not least, my former colleague Robert Moffit expressed concerns in a column for USA Today. The part that caught my eye was that CBO has a less-than-stellar track record on Obamacare projections.

The GOP should be skeptical of CBO’s coverage estimates. It has been an abysmal performance. For example, CBO projected initially that 21 million persons would enroll in exchange plans in 2016. The actual enrollment: 11.5 million.

The bottom line is that CBO overstated the benefits of Obamacare, at least as measured by the number of people who would sign up for the program.

The bureaucrats were way off.

Yet CBO continues to use those inaccurate numbers, creating a make-believe baseline that is then used to estimate a large number of uninsured people if the Republican bill is enacted.

This is sort of like the “baseline math” that is used to measure supposed spending cuts when the budget actually is getting bigger.

P.S. You may be wondering why Republicans don’t fully repeal Obamacare so that they can get credit for falling premiums. Part of the problem is that they are using “reconciliation” legislation that supposedly is limited to fiscal matters. In other words, you can’t repeal red tape and regulation. At least according to some observers. I think that’s silly since such interventions drive up the cost of health care, which obviously has an impact on the budget. Also, Republicans are a bit squeamish about reducing subsidies for various groups, whether explicit (like the Medicaid expansion) or implicit (like community rating). In other words, the Second Theorem of Government applies.

Reposted from International Liberty

I have a guilty pleasure to admit that will likely bring my libertarian credentials into question: I watch and listen to public broadcasting.

I’ve bonded particularly with their children’s programming because of my young son’s love for it. He adores shows like Daniel Tiger’s Neighborhood, Curious George, and all of the unique children’s programming offered by PBS.

Public broadcasting can survive privatization. In fact, it would likely thrive by monetizing their unique content.

My household is not alone in our enjoyment of PBS, NPR, or other products of public broadcasting. Millions of Americans tune into public broadcasting on a daily basis.

The size of this audience can be easily detected by the outpouring of support whenever defunding of public broadcasting is discussed. With Donald Trump in office, the caterwauling has resumed after a long period of quiet on the issue. We haven’t witnessed fervor like this since Mitt Romney’s so-called “war on Big Bird”. (As you’ll learn later, privatizing Sesame Street is one of the best things to ever happen to the show.)

However, most of this outrage is as misguided and shortsighted as it is shrill. The truth of the matter is that public broadcasting can survive privatization. In fact, it would likely thrive by monetizing their unique content.

This is evidenced by the drastically different paths taken by the two organizations that embody public broadcasting: NPR and PBS. One provider has been wheeling-and-dealing in an effort to cash in on its unique content, while the other clutches to its antiquated and costly distribution practices.

It’s a tale of two (soon-to-be-defunded) public broadcasting providers.

NPR Clings to Outdated Formula

In March 2016, Christopher Turpin, NPR’s vice president of news programming and operations, laid out a series of internal policies in a memo. Some of the policies demonstrated a troubling commitment to NPR’s dying business model.

Based on the rules outlined in these memos, show hosts are discouraged from promoting any NPR-branded podcasts. “We won’t tell people to actively download a podcast or where to find them,” reads the memo. “No mentions of npr.org, iTunes, Stitcher, NPR One, etc.”

NPR’s reluctance to embrace modern digital trends speaks volumes about its commitment (or lack thereof) to adjusting to market trends. “The ban was widely viewed as proof that NPR is less interested in reaching young listeners than in placating the managers of local member stations, who pay handsome fees to broadcast NPR shows and tend to react with suspicion when NPR promotes its efforts to distribute those shows digitally,” writes Slate’s Leon Neyfakh. (Neyfakh’s deep-dive into the wastefulness and antiquated nature of NPR is very insightful.)

As more and more people are jettisoning their radios for internet-based streaming content, this outdated formula is draining public broadcasting’s ability to innovate.

Even flagship shows like Morning Edition and All Things Considered, which generate more revenue for NPR via licensing fees than any other source of funding, have been shutout in the great digital conversion.

Member stations continue to oppose offering these shows as podcasts. Losing listeners and revenue to such digital disruption threatens the very existence of “legacy stations.” This is why representatives from member stations have worked hard to maintain a majority on NPR’s board of directors, so they could block any efforts to digitize.

In addition to outdated philosophy, the funding mechanism that supports NPR is also antiquated. The Public Broadcasting Act of 1967 codified the financial structure of the Corporation of Public Broadcasting (CPB), and not much has changed since it was signed into law by President Lyndon Johnson.

The majority of the funding established by the act—roughly 70 percent—was allocated not for content, but for maintaining a costly network of 1,100 regional stations across the country. CPB spends almost $100 million annually in “unrestricted” grants on existing radio infrastructure maintenance, community outreach, and other non-programming related expenses.

As more and more people are jettisoning their radios for internet-based streaming content, this outdated formula is draining public broadcasting’s ability to innovate. Defunding public broadcasting would incentivize the organization to invest in the server space necessary to compete in the digital economy or develop new programming.

PBS Is Embracing the Marketplace

On the other side of the equation stands PBS, which offers a successful model for transitioning public broadcasting to a private space.

PBS is far from perfect. The organization makes it unnecessarily difficult to syndicate new shows through their distribution networks. However, despite the current howling over privatizing public broadcasting, PBS has already trended in that direction.

The shift to online streaming video has helped PBS ink several deals with prominent online content providers.

Let’s return to the aforementioned “War on Big Bird” waged by Romney. It turns out that Big Bird’s home on Sesame Street was already on the verge of foreclosure long before Mitt could get his mitts on it. Around the same time the public was lambasting the former GOP frontrunner for threatening to defund PBS, Sesame Street was operating at a huge loss—nearly $11 million in 2014.

Then HBO came along. Already in the market to compete with Netflix and Amazon Prime for children’s programming, HBO secured a five-year deal with PBS that, according to Hollywood Reporter, allowed “the iconic kids’ franchise to deliver nearly twice as much new content per season.” The market saved Big Bird.

Markets have also embraced other children’s programming originally found on PBS.

The shift to online streaming video has helped PBS ink several deals with prominent online content providers. Amazon Prime netted the biggest deal with PBS, securing the rights to Daniel Tiger’s Neighborhood, Odd Squad, Wild Kratts, Dinosaur Train, Nature Cat, and Ready Jet Go. Curious George is exclusively streamed on Hulu, while Super Why! remains on Netflix.

Aside from children’s programming, adult content typically offered on public broadcasting has also moved online. Netflix streams several Ken Burns documentary series, including The Civil War, Prohibition, and The Roosevelts.

It is obvious that PBS is drastically ahead of the curve in comparison to NPR.

Netflix and Chill Out

The key to the transition of public broadcasting into the private sphere is an axiom familiar to marketers: content is king. When you produce thoughtful and entertaining content, consumers will knock down your doors to access it.

Consider the rise and fall and rise of Netflix. In 2011, Netflix almost struck a fatal, self-inflicted wound when they altered the pricing and availability of their mail-in and streaming services. In an awkward attempt to restructure, Netflix created Qwikster as a separate company to handle the mail-in DVD side of the business. Many subscribers felt slighted. As a result, nearly 800,000 customers unsubscribed, Netflix’s stock went into a nose dive, and Quikster got the ax. It suffered a more humiliating market defeat than Blockbuster.

Public broadcasting has the numbers to survive privatization.

In an effort to rebuild its brand, Netflix focused its energy on offering new and original content. Consider the quantity and quality of highly-acclaimed series that originated with Netflix: Orange is the New Black, House of Cards, Bloodline, Stranger Things, Black Mirror, The Crown, Narcos, etc. Netflix also worked to secure exclusive distribution rights to already established, popular shows like Peaky Binders.

In fact, Netflix is slated to spend nearly $6 billion in writing, producing, casting, and securing distribution for its unique selection of “Netflix Originals” in 2017.

This resilient comeback has bolstered Netflix’s subscriptions with over 75 million subscribers in 200 different countries.

If Netflix can bounce back, public broadcasting can easily survive privatization. Considering that PBS viewership is over 95 million and at least 23 million people tune into at least one NPR radio show per day—all dedicated consumers tuning into the unique content only available through their networks—public broadcasting has the numbers to survive privatization.

If public broadcasting organizations shifted all of their efforts to content development (branding the existing shows and creating new ones), and away from the costly upkeep of its regional stations, it is painfully apparent that the marketplace would support them.

NPR and PBS fans need to take a lesson from Netflix and chill out.

Got Amazon Prime, You Already Support Privatization

Even though I am a fan of the content available on public broadcasting, I would gladly support abolishing the CPB. I don’t expect my neighbors to pay for my entertainment.

Furthermore, considering the unique content already produced by these organizations, I have the utmost confidence that public broadcasting networks can continue to find success selling exclusive rights to their programming. Competition for selling publishing rights is robust, demonstrated by the availability of existing platforms to stream said content: Amazon Prime, Hulu, HBO, Netflix, Audible, Spotify, etc. Subscriptions to all of these platforms are extremely affordable and offer other perks. (If you haven’t experienced two-day shipping by Amazon Prime yet, you need to come out of the dark ages.)

So when I say I would gladly support public broadcasting after it is privatized with my own money, I mean it, because—as my subscriptions to many streaming services indicate—I am already doing so.

Now, if you’ll excuse me I’m going to fire up Amazon Prime so my kiddo can watch Daniel Tiger’s Neighborhood.

Jay Stooksberry is a freelance writer with passions for liberty, skepticism, fatherhood, humor, and whiskey. His work has been published in Newsweek, Independent Voter Network, Fatherly, and other publications. When he’s not writing, he splits his time between marketing consultation, outreach work for his local Libertarian Party affiliate, and enjoying his spare time with his wife and son. Follow him on Facebook and Twitter.

This article was originally published on FEE.org. Read the original article.

Between 1998 and 2016 prices for “Medical Care Services” in the US (as measured by the BLS’s CPI for Medical Care Services) more than doubled (+100.5% increase) while the prices for “Hospital and Related Services” nearly tripled (+177% increase). Those increases in the costs of medical-related services compare to only a 47.2% increase in consumer prices in general over that period. On an annual basis, the cost of medical care services in the US have increased almost 4% per year since 1998 and the cost of hospital services increased annually by 5.8%.

In contrast, overall inflation averaged only 2.2% per year over that period. The only consumer product or service that has increased more than medical care services and about the same as hospital costs over the last several decades is college tuition and fees, which have increased nearly 6% annually since 1998 for public universities.

One of the reasons that the costs of medical care services in the US have increased more than twice as much as general consumer prices since 1998 is that a large and increasing share of medical costs are paid by third parties (private health insurance, Medicare, Medicaid, Department of Veterans Affairs, etc.) and only a small and shrinking percentage of health care costs are paid out-of-pocket by consumers.

According to government data, almost half (47.6%) of health care expenditures in 1960 were paid by consumers out-of-pocket, and by 1990 that share had fallen to 19% and by 2015 to only 10.5% (see chart above).

It’s no big surprise that overall health care costs have continued to rise over time as the share of third-party payments has risen to almost 90% and the out-of-pocket share approaches 10%. Consumers of health care have significantly reduced incentives to monitor prices and be cost-conscious buyers of medical and hospital services when they pay only about 10% themselves, and the incentives of medical care providers to hold costs down are greatly reduced knowing that their customers aren’t paying out of pocket and aren’t price sensitive.

Cosmetic Surgery Market

How would the market for medical services operate differently if prices were transparent and consumers were paying out-of-pocket for medical procedures in a competitive market? Well, we can look to the $15 billion US market for elective cosmetic surgery for some answers.

In every year since 1997, the American Society for Aesthetic Plastic Surgery has issued an annual report on cosmetic procedures in the US, both surgical and nonsurgical, that includes the number of procedures, the average cost per procedure (starting in 1998), the total spending per procedure, and the age and gender distribution for each procedure and for all procedures. Here is a link to the press release for the 2016 report, and the full report is available here.

The table above displays the 20 cosmetic procedures that were available in both 1998 and 2016, the average prices for those procedures in each year (in current dollars), the number of each of those procedures performed in those two years, and the percent increase in average price for each procedure between 1998 and 2016. The procedures are ranked by the number of procedures last year.

Here are some interesting findings from this year’s report and the table above:

1. For the top ten most popular cosmetic procedures displayed above for last year, none of them has increased in price since 1998 more than the 47.2% increase in overall consumer prices, meaning that the real, inflation-adjusted price of all ten of those procedures has fallen over the last 18 years.

2. For the three most popular procedures in 2016 (botox, laser hair removal, and chemical peel – all nonsurgical cosmetic procedures), the nominal price for each has actually fallen since 1998 by large double-digit percentage declines of -11.3%, -21.7% and -34.8% respectively.

Patients that pay out-of-pocket are cost-conscious and have strong incentives to shop around and compare prices.

That is, the prices for those procedures have fallen in price since 1998 measured in current dollars, even before making any adjustments for inflation. Note also that the demand for those three procedures has increased dramatically, especially botox procedures (29-time increase since 1998) and laser hair removal (9.5-time increase).

3. The two most popular surgical cosmetic procedures last year were liposuction and breast augmentation, which have increased in current dollar prices by 30.6% and 26.2% respectively since 1998. Both of those average price increases were less than the 47.2% increase in consumer prices over the last 18 years, meaning that the real, inflation-adjusted prices for liposuction and breast augmentation procedures have fallen since 1998.

4. The average price increase between 1998 and 2016 for the 20 cosmetic procedures displayed above was 32%, which is less than the 47.2% increase in consumer prices in general. Of the 20 procedures above, 14 increased in price by less than overall inflation (and therefore decreased in real terms) and only six increased in price by more than inflation.

And most importantly, none of the 20 cosmetic procedures in the table above have increased in price by anywhere close to the 100.5% increase in the price of medical care services or the 176.7% increase in hospital services since 1998. The largest cosmetic procedure price increase since 1998 was the nearly 70% increase for upper arm lift surgery, which is still far below the doubling of prices for medical services overall.

5. As in previous years, there was a huge gender imbalance for cosmetic procedures last year–women accounted for 12.43 million procedures and more than 91% of the 13.65 million total cosmetic procedures performed last year.

The Role of Insurance

The competitive market for cosmetic procedures operates differently than the traditional market for health care in important and significant ways. Cosmetic procedures, unlike most medical services, are not usually covered by insurance. Patients paying 100% out-of-pocket for elective cosmetic procedures are cost-conscious and have strong incentives to shop around and compare prices at the dozens of competing providers in any large city.

The greater the degree of market competition, price transparency, and out-of-pocket payments, the more contained prices are, in health care or any other sector.

Providers operate in a very competitive market with transparent pricing and therefore have incentives to provide cosmetic procedures at competitive prices. Those providers are also less burdened and encumbered by the bureaucratic paperwork that is typically involved with the provision of most standard medical care with third-party payments.

Because of the price transparency and market competition that characterizes the market for cosmetic procedures, the prices of most cosmetic procedures have fallen in real terms since 1998, and some non-surgical procedures have even fallen in nominal dollars before adjusting for price changes.

In all cases, cosmetic procedures have increased in price by far less than the 100.5% increase in the price of medical care services between 1998 and 2016 and the 176.6% increase in hospital services. In summary, the market for cosmetic surgery operates like other competitive markets with the same expected results: falling real prices over time for many cosmetic procedures.

Quick Question

If cosmetic procedures were covered by third-party payers like insurance companies, Medicare, and Medicaid, what would have happened to their prices over time? Basic economics tell us that those prices would have most likely risen at about the same 100.5% increase in the prices of medical services in general between 1998 and 2016.

The main economic lesson here is that the greater the degree of market competition, price transparency and out-of-pocket payments, the more contained prices are, in health care or any other sector of the economy. Another important economic lesson is that the greater the degree of government intervention, opaque prices and third-party payments, the less contained prices are, in health care or any other sector of the economy. Some important lessons to consider as we attempt to reform national health care… once again.

Reprinted from American Enterprise Institute.

Mark J. Perry is a scholar at the American Enterprise Institute and a professor of economics and finance at the University of Michigan’s Flint campus.

This article was originally published on FEE.org. Read the original article.

March 23, 2017 by Dan Mitchell

I’m flabbergasted when people assert that America’s costly and inefficient healthcare system is proof that free markets don’t work.

In hopes of helping them understand what’s really going on, I try to explain to them that an unfettered market involves consumers and producers directly interacting with their own money in an open and competitive environment.

In hopes of helping them understand what’s really going on, I try to explain to them that an unfettered market involves consumers and producers directly interacting with their own money in an open and competitive environment.

I then explain why that’s not a description of the U.S. system. Not even close. As I noted in Part I, consumers directly finance only 10.5 percent of their healthcare expenses. Everything else involves a third-party payer thanks to government interventions such as Medicare, Medicaid, the healthcare exclusion, the Veterans Administration, etc.

Obamacare then added another layer of intervention to the existing mess. By my rough calculations, that costly boondoggle took the country from having a system that was 68-percent controlled and dictated by government to a system where government dictates and controls 79 percent of the system.

to a system where government dictates and controls 79 percent of the system.

This is very relevant because Republicans in Washington are now trying to “repeal and replace” Obamacare, but they’re confronting a very unpleasant reality. Undoing that legislation won’t create a stable, market-driven healthcare system. Instead, we’d only be back to where we were in 2010 – a system where government would still be the dominant player and market forces would be almost totally emasculated.

The only difference is that Republicans would then get blamed for everything that goes wrong in the world of healthcare rather than Obama and the Democrats (and you better believe that’s a big part of the decision-making process on Capitol Hill).

Yes, the GOP plan would save some money, which is laudable, but presumably the main goal is to have a sensible and sustainable healthcare system. And that’s not going to happen unless there’s some effort to somehow unravel the overall mess that’s been created by all the misguided government policies that have accumulated over many decades.

This isn’t a new or brilliant observation. Milton Friedman wrote about how government-controlled healthcare leads to higher costs and lower quality back in 1977, but I can’t find an online version of that article, so let’s look at what he said in a 1978 speech to the Mayo Institute.

I realize that many people won’t have 45 minutes of spare time to watch the entire video, so I’ll also provide some excerpts from a column Friedman wrote back in the early 1990s that makes the same points. He started by observing that bureaucratic systems have ever-rising costs combined with ever-declining output.

…a study by Max Gammon…comparing input and output in the British socialized hospital system…found that input had increased sharply, while output had actually fallen. He was led to enunciate what he called “the theory of bureaucratic displacement.” In his words, in “a bureaucratic system . . . increase in expenditure will be matched by fall in production. . . . Such systems will act rather like `black holes,’ in the economic universe, simultaneously sucking in resources, and shrinking in terms of `emitted production.’” …concern about the rising cost of medical care, and of proposals to do something about it — most involving a further move toward the complete socialization of medicine — reminded me of the Gammon study and led me to investigate whether his law applied to U.S. health care.

Friedman then noted how this bureaucratic rule operated in the United States after the healthcare exclusion was adopted during World War II.

Even a casual glance at figures on input and output in U.S. hospitals indicates that Gammon’s law has been in full operation for U.S. hospitals since the end of World War II… Before 1940, input and output both rose, input somewhat more than output, presumably because of the introduction of more sophisticated and expensive treatment. The cost of hospital care per resident of the U.S., adjusted for inflation, rose from 1929 to 1940 at the rate of 5% per year; the number of occupied beds, at 2.4% a year. Cost per patient day, adjusted for inflation, rose only modestly. The situation was very different after the war. From 1946 to 1989, the number of beds per 1,000 population fell by more than one-half; the occupancy rate, by one-eighth. In sharp contrast, input skyrocketed. Hospital personnel per occupied bed multiplied nearly seven-fold and cost per patient day, adjusted for inflation, an astounding 26-fold.

Friedman then explained that the adoption of Medicare and Medicaid hastened the erosion of market forces.

One major engine of these changes was the enactment of Medicare and Medicaid in 1965. A mild rise in input was turned into a meteoric rise; a mild fall in output, into a rapid decline. …The federal government’s assumption of responsibility for hospital and medical care for the elderly and the poor provided a fresh pool of money, and there was no shortage of takers. Personnel per occupied bed, which had already doubled from 1946 to 1965, more than tripled from that level after 1965. Cost per patient day, which had already more than tripled from 1946 to 1965, multiplied a further eight-fold after 1965. Growing costs, in turn, led to more regulation of hospitals, further increasing administrative expense.

Remember, Friedman wrote this article back in 1991. And the underlying problems have gotten worse since that time.

So what’s the bottom line? Friedman pointed out that the problem is too much government.

The U.S. medical system has become in large part a socialist enterprise. Why should we be any better at socialism than the Soviets?

And he explained that there’s only one genuine solution.

The inefficiency, high cost and inequitable character of our medical system can be fundamentally remedied in only one way: by moving in the other direction, toward re-privatizing medical care.

Some readers may be skeptical. Even though he cited lots of historical evidence, perhaps you’re thinking Friedman’s position is impractical.

So let’s fast forward to 2017 and look at some very concrete data assembled by Mark Perry of the American Enterprise Institute. He looks at medical costs over the past 18 years and compares what’s happened with prices for things that are covered by third-party payer (either government or government-distorted private insurance) and prices for cosmetic procedures that are financed directly by consumers.

As you can see, the relative price of health care generally declines when people are spending their own money and operating in a genuine free market. But when there’s third-party payer, relative prices rise.

Perry explains the issue very succinctly.

Cosmetic procedures, unlike most medical services, are not usually covered by insurance. Patients paying 100% out-of-pocket for elective cosmetic procedures are cost-conscious, and have strong incentives to shop around and compare prices at the dozens of competing providers in any large city. Providers operate in a very competitive market with transparent pricing and therefore have incentives to provide cosmetic procedures at competitive prices. Those providers are also less burdened and encumbered by the bureaucratic paperwork that is typically involved with the provision of most standard medical care with third-party payments. Because of the price transparency and market competition that characterizes the market for cosmetic procedures, the prices of most cosmetic procedures have fallen in real terms since 1998, and some non-surgical procedures have even fallen in nominal dollars before adjusting for price changes. In all cases, cosmetic procedures have increased in price by far less than the 100.5% increase in the price of medical care services between 1998 and 2016 and the 176.6% increase in hospital services.

In other words, a free market can work in healthcare. And it gives us falling prices and transparency rather than bureaucracy and inefficiency. Maybe when they’ve exhausted all other options, Republicans will decide to give freedom a try.

P.S. If you want to get a flavor for how competition and markets generate better results, watch this Reason TV video and read these stories from Maine and North Carolina.

February 26, 2017 by Dan Mitchell

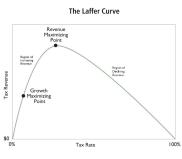

In my never-ending strategy to educate policy makers about the Laffer Curve, I generally rely on both microeconomic theory (i.e., people respond to incentives) and real-world examples.

And my favorite real-world example is what happened in the 1980s when Reagan cut the top tax rate from 70 percent to 28 percent.  Critics said Reagan’s reforms would deprive the Treasury of revenue and result in rich people paying a lot less tax. So I share IRS data on annual tax revenues from those making more than $200,000 per year to show that there was actually a big increase in revenue from upper-income taxpayers.

Critics said Reagan’s reforms would deprive the Treasury of revenue and result in rich people paying a lot less tax. So I share IRS data on annual tax revenues from those making more than $200,000 per year to show that there was actually a big increase in revenue from upper-income taxpayers.

It has slowly dawned on me, though, that this may not be the best example to share if I’m trying to convince skeptical statists. After all, they presumably don’t like Reagan and they may viscerally reject my underlying point about the Laffer Curve since I’m linking it to the success of Reaganomics.

So I have a new strategy for getting my leftist friends to accept the Laffer Curve. I’m instead going to link the Laffer Curve to “successful” examples of left-wing policy. To be more specific, statists like to use the power of government to control our behavior,  often by imposing mandates and regulations. But sometimes they impose taxes on things they don’t like.

often by imposing mandates and regulations. But sometimes they impose taxes on things they don’t like.

And if I can use those example to teach them the basic lesson of supply-side economics (if you tax something, you get less of it), hopefully they’ll apply that lesson when contemplating higher taxes on thing they presumably do like (such as jobs, growth, competitiveness, etc).

Here’s a list of “successful” leftist tax hikes that have come to my attention.

Now I’m going to augment this list with an example from the United Kingdom.

By way of background, there’s been a heated housing market in England, with strong demand leading to higher prices. The pro-market response is to allow more home-building, but the anti-developer crowd doesn’t like that approach, so instead a big tax on high-value homes was imposed.

And as the Daily Mail reports, this statist approach has been so “successful” that the tax hike has resulted in lower tax revenues.

George Osborne’s controversial tax raid on Britain’s most expensive homes has triggered a dramatic slump in stamp duty revenues. Sales of properties worth more than £1.5million fell by almost 40 per cent last year, according to analysis of Land Registry figures… This has caused the total amount of stamp duty collected by the Treasury to fall by around £440million, from £1.079billion to a possible £635.7million. The figures cover the period between April and November last year compared to the same period in 2015.

Our leftist friends, who sometimes openly admit that they want higher taxes on the rich even if the government doesn’t actually collect any extra revenue, should be especially happy because the tax has made life more difficult for people with more wealth and higher incomes.

Those buying a £1.5 million house faced an extra £18,750 in stamp duty. …Tory MP Jacob Rees-Mogg…described Mr Osborne’s ‘punitive’ stamp duty hikes as the ‘politics of envy’, adding that they have also failed because they have raised less money for the Treasury.

By the way, the fact that the rich paid less tax last year isn’t really the point. Instead, the lesson to be learned is that a tax increase caused there to be less economic activity.

So I won’t care if the tax on expensive homes brings in more money next year, but I will look to see if fewer homes are being sold compared to when this tax didn’t exist.

And if my leftist friends say they don’t care if fewer expensive homes are being sold, I’ll accept they have achieved some sort of victory. But I’ll ask them to be intellectually consistent and admit that they are implementing a version of supply-side economics  and that they are embracing the notion that tax rates change behavior.

and that they are embracing the notion that tax rates change behavior.

Once that happens, it’s hopefully just a matter of time before they recognize that it’s not a good idea to impose high tax rates on things that are unambiguously good for an economy, such as work, saving, investment, and entrepreneurship.

Yes, hope springs eternal.

P.S. In addition to theory and real-world examples, my other favorite way of convincing people about the Laffer Curve is to share the poll showing that only 15 percent of certified public accountants agree with the leftist view that taxes have no impact have taxable income. I figure that CPAs are a very credible source since they actually do tax returns and have an inside view of how behavior changes in response to tax policy.

Reposted from International Liberty

Related articles:

Both articles above include these three videos describing Art Laffer actually wrote about “the Laffer Curve”.

Part I describes the theory.

Part II describes the evidence.

And Part III explains the sloppy and inaccurate revenue-estimating methodology of the Joint Committee on Taxation.

But if [you] think [this] too biased or that Art is similarly misguided, then [you] should look at some of the evidence produced by other economists.

The sooner [the voters] get up to speed on these issues, the sooner they can help give politicians good advice so that the Laffer Curve doesn’t cause more unpleasant surprises.

More Articles regarding tax structuring –

The truth that makes men free is for the most part the truth which men prefer not to hear.

—- Herbert Agar

American health care is not very effective in curing diseases. The National Center for Health Statistics projects over 1.6 million new cancer cases and almost 600,000 cancer deaths for 2016. Among those who suffer heart attacks, fewer than 50% are alive five years later.

Republicans do not want to repeal the regulations that make healthcare expensive and ineffective.

Medical treatment is so expensive that people need insurance to survive financial catastrophe in case they become ill or get hurt. Even middle class folks who need extensive medical care cannot begin to pay the costs. Those facts supported demand for Obamacare, the halfway point on the road to socialized medicine.

Republicans argue that American medicine was the finest in the world, with only minor problems, until it was ruined by Obamacare. But American medicine has been plagued with extraordinarily high costs and ineffective treatments for many years.

According to Forbes.com, in the Commonwealth Fund’s 2014 healthcare survey of the eleven wealthiest countries, the USA came in last.

Republicans campaigned to repeal Obamacare. But they waffle about its replacement, because they sense they have no answers to the problems that predated the disastrous Affordable Care Act. Republicans want medicine to be inexpensive and effective, but they do not want to repeal the morass of regulations that make it expensive and ineffective.

A Brief History of Medical Regulations

After the Civil War, there were virtually no regulations of medicine in the United States. People would choose their doctor and treatment, and doctors would thrive or languish according to the exigencies of the market. Profit-seeking medical schools flourished and graduated many practitioners.

However, the rise of the Progressive Movement soon inspired doctors to lobby legislatures to license physicians, so that only those approved by the state could practice medicine.

The advertised goal of the political doctors was to stamp out what they considered to be bad medical practice and thereby improve the lives of their patients. But their medical journals and meetings revealed other objectives. The crusading doctors emphasized that medical licensing would reduce the numbers of practicing physicians, and thereby increase their incomes and enhance their social standing as members of a restrictive guild.

For example, Dr. Stanford Chaillie, Professor of Physiology and Anatomy at the University of Louisiana, wrote in 1874 that,

The profession has good reason to urge that the number of (medical graduates) is large enough to diminish the profits of its individual members, and that if educational requirements were higher, there would be fewer doctors and larger profits for the diminished number.”

Pushed by persistent physician lobbying, seventeen states enacted medical licensing laws by 1887. The next year, the president of the American Medical Association (AMA), Dr. AYP Garnett, urged national convention delegates to systematically lobby every legislature for the purpose of reducing the number of medical schools, and thereby, the number of doctors.

By the early twentieth century, the AMA had positioned itself as by far the most powerful political force in organized medicine. By elevating political lobbying above all other activities, it succeeded in passing legislation in virtually every state. New laws mandated that licensing applicants attend medical schools “in good standing” with the State Medical Board, and pass a state examination administered by the Board.

Established physicians were exempted from these requirements.

“Regular” Medicine

The Medical Boards among the various states were staffed by doctors who had lobbied for the passage of licensing laws. The boards were empowered to decree which medical schools would be allowed to operate. So, they gradually reduced the number of medical schools, a long standing goal of organized medicine.

The licensing boards required approved medical schools to teach curriculum consistent with the ideas of “regular” medicine. Regular doctors had long sought to outlaw the practice of non-orthodox medicine, consisting mainly of homeopaths and eclectics, who represented about 12% of practicing physicians. From the 1830’s through the 1850’s, these two sects had been instrumental in repealing medical regulations left over from the Colonial Period.

Homeopaths recommended miniscule doses of special curative elements, and eclectics emphasized herbal remedies. In contrast, regular medicine, as late as the 1870’s and 1880’s, looked to “heroic therapy”: Bleeding and blistering, purgation by means of induced vomiting or laxatives, and administering large doses of metallic compounds, including mercury and other poisons.

Regular doctors lacked the political power to outlaw the practice of heterodox medicine. However, by controlling the licensing boards, they were able to suppress teaching of heterodox ideas in medical schools that all aspiring medical practitioners were required to graduate.

Today’s expensive, often ineffective, therapy is the result of a state-run medical cartel, not free enterprise.

As the twentieth century rolled in, organized medicine continued to complain about a “surplus” of practitioners competing for supposedly inadequate remuneration. Licensing laws in every state but Alaska had failed to turn back the tides of competition. Political doctors responded by demanding ever greater restrictions on medical schooling and practice, and applied pressure to prosecutors reluctant to enforce the unpopular licensing laws.

Eventually, the number of approved medical schools fell so low, and the requirements for admission became so elevated, that many tens of thousands of applicants were turned away every year.

Medical practice became a guarantee of princely income for any who could make it through medical school and residency and pass the medical board examinations. Medical schools indoctrinated aspiring doctors with official orthodoxy; any who challenged these ideas were punished and ostracized. Essentially, most doctors (with outstanding exceptions) became highly paid quasi-officials of medicine, rather than entrepreneurs devoted to medical science.

Once medical care was established as an extension of the state’s police powers, bureaucratic meddling became the norm. The doctors’ guild forced Americans to pay sky high medical fees, a plight that worsened as restrictions and mandates grew. Today’s expensive, sometimes ineffective therapy is the result of a state-run medical cartel, not free enterprise.

Medical Licensing Laws Ought to be Repealed

Licensing laws, which lie at the base of the medical mess, should be repealed. Let anyone who wants to try to attract customers hang out her shingle as a practitioner, subject only to law prohibiting fraud. Medical costs will plummet. Entrenched medical ideology will be challenged on a thousand fronts, producing a revolution—many revolutions—in medical thinking that will benefit patients.

Progressives and guild doctors say that economic freedom would be disastrous for Americans. They argue that people fall for bad ideas and false promises. They need the authority of the medical guild to guide them in making safe choices.

Scientists and doctors are responsible for brilliant breakthroughs in healing which political authority can only obstruct.

But the authority of the medical guild is false in important ways, despite its pretense to science. Government bureaus and state-privileged medical societies cannot identify truth, or discover cures. They can only defer to political consensus about proper medical thinking. Political consensus is formed with attention to the beliefs of other people, not with respect for facts of science.

Science requires making proper distinctions between truth and falsehood. This requires good thinking. But thinking is an individual exercise, not a collective feeling. Individuals choose to think, or not to think; to identify contradictions or cast them out of mind; to persist, or stop trying; to conform, or question. This is why the merit and character of one’s thinking differs radically from that of another.

Individual scientists and doctors are responsible for brilliant breakthroughs in understanding and healing. Political authority cannot guide or guard thinking, only obstruct or punish it.

Make Informed Choices

But without political authority, who will protect us from bad ideas?

People can protect themselves. The market process enables ordinary people to make informed choices about complicated subjects. Get rid of the medical cartel and its bureaucratic overseers. Then people will seek their own answers, just as they do regarding automobiles, computers and other complexities. People read, they consult experts and they investigate the reputations of providers. Good ideas work; bad ideas fail. People quickly find out what worked, or did not work, for others.

When Americans are free to think and choose for themselves, our medical mess will evaporate. A flourishing medical market will sweep away regulatory debris and deliver affordable and helpful healing.

Mark Humphrey has published editorials in the Orange County Register, The Journal of Commerce, the Great Falls (Montana) Tribune, and capitalism.net.

This article was originally published on FEE.org. Read the original article.

Government exists by consent of the People

Government exists by consent of the People

Government exists by consent of the People

Government exists by consent of the People

Government exists by consent of the People

Government exists by consent of the People

Government exists by consent of the People

Government exists by consent of the People

Just another WordPress.com site

Government exists by consent of the People

Government exists by consent of the People

Government exists by consent of the People

Government exists by consent of the People

Government exists by consent of the People

Government exists by consent of the People

Government exists by consent of the People

Government exists by consent of the People

Government exists by consent of the People

Government exists by consent of the People

Government exists by consent of the People

Government exists by consent of the People

Government exists by consent of the People

Government exists by consent of the People

Government exists by consent of the People

Government exists by consent of the People

Restraining Government in America and Around the World